(This is a sequel to the previous “Late-Stage Capitalism and the Enclosure of Environmental Data” post)

The Emperor’s New Debt: Clothing the Naked System

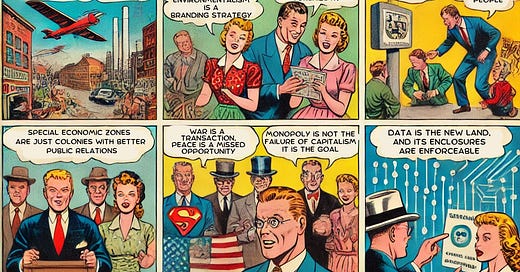

Like the emperor parading through the streets in invisible robes, the U.S. economy has cloaked itself in the illusion of strength, propped up by artificial market speculation, unsustainable debt, and the remnants of Cold War-era financial dominance, yet beneath the carefully woven narrative, it stands exposed—fragile, overleveraged, and increasingly unable to disguise its unraveling foundations.

Let us consider that since the 2008 financial collapse and subsequent bailouts, the U.S. national debt has surged from $10 trillion to $36 trillion—a staggering increase that has pushed the debt-to-GDP ratio from approximately 63% to over 120%. This debt explosion has been accompanied by a sustained erosion of public protections, regulatory oversight, and government compliance, particularly since crossing the 90% debt-to-GDP threshold in 2012—once considered a red line by the IMF. While pundits from both the left and the right dismissed concerns about debt, arguing that the U.S. dollar’s ‘fiat’ status rendered such worries irrelevant, this was only a half-truth. The U.S. dollar has only appeared to function as a fiat currency because its status as the international trade currency is artificially sustained by stock market speculation, a basket of other currencies, and structural financial dependencies.

I have written about this elsewhere, so I won’t expand on it here, but this was the fundamental flaw with the U.S. assuming the role of the global reserve currency, having co-opted the intended non-national Bancor that was originally proposed at Bretton Woods in 1944. The economic struggles of much of the world today are not just incidental, but are directly linked to Cold War-era policies, particularly the 1948 Economic Cooperation Act—better known as the Marshall Plan. While it may have benefited the U.S.-led OECD economies, its gains were largely limited to those who achieved middle-class status, leaving many behind even among its strongest benefactor states.

And now, since 2008, how many have fallen out of the middle class due to the unchecked predatory forces of capitalism? The crisis extends across healthcare, housing, finance, energy, food and water security, education, media consolidation, and surveillance capitalism. If we are to truly understand the motivations behind neoliberal global governance, we must recognize that the greatest threat to those industry leaders who consolidate wealth and power is not war, nor terrorism, nor financial collapse—it is BRICS (Brazil, Russia, India, China, South Africa) multilateralism. This is the lens through which we must reframe coups, destabilization efforts, economic bullying, containment strategies, and obstructionist policies since 2012—all the provocations that push nations and economies past the boundaries of “peace” toward war and revolution.

The Chicken and Egg Conundrum: What came first the Pacific Pivot or BRICS?

The answer is evident—the realignment of protectionist emerging economies within BRICS came first, as these nations remained relatively stable after the 2008 financial collapse while Western economies faltered under the weight of financialized capitalism and debt crises. The U.S. response to this shifting balance of power was not coincidental but strategic, leading to Obama’s Pacific Rebalance and the obstructionist policies of the Trans-Pacific Partnership (TPP) in 2011.

BRICs met in 2009 and expanded to include South Africa in 2010, marking the first serious multilateral challenge to U.S.-led financial and geopolitical dominance in the post-Cold War era. This was not just an economic bloc but a strategic realignment against dollar hegemony, a direct response to the reckless deregulation that led to the 2008 collapse. BRICS’ stability and coordinated policies threatened to undermine the unilateral global governance model dominated by Washington, particularly through its moves toward de-dollarization, alternative financial institutions (e.g., the New Development Bank), and regional infrastructure investments that bypassed Western lenders.

The U.S. response was swift and multipronged. Within a year of BRICS’ expansion to South Africa, the Obama administration launched the “Pacific Rebalance” strategy, which was both a military and economic maneuver aimed at containing China and securing U.S. dominance in Asia. The Trans-Pacific Partnership (TPP)—which explicitly excluded China while securing U.S. economic influence over Asia-Pacific trade—was the economic arm of this containment strategy. Simultaneously, the U.S. and its allies began targeting BRICS economies through covert and overt destabilization efforts.

Brazil and South Africa were subjected to “soft coups” under the pretext of anti-corruption charges (Lula da Silva in 2016, Jacob Zuma in 2018), disrupting BRICS’ cohesion.

Russia faced mounting economic and military containment efforts, particularly through NATO expansion, and disruptions to the development of the Eurasia Economic Union (EAEU), which directly led to the 2014 US-backed coup of democratically elected Victor Yanukovych who was leading Ukraine away from the neoliberal EU membership, towards the EAEU.

China became the primary target of U.S. economic warfare, with trade sanctions, military encirclement in the South China Sea, and the Pacific Rebalance designed to contain its rise.

India was courted aggressively by Washington, with the U.S. leveraging Modi’s leadership to pull India away from full BRICS alignment and push it towards Quad (U.S.-Japan-Australia-India) military cooperation as a counterweight to China.

Argentina and Pakistan, both who have sought inclusion into the expanded BRICS+ also faced “color revolution” regime change.

None of this was accidental or reactionary—it was a preemptive effort to dismantle BRICS before it could gain significant global traction. The pattern of soft coups, trade alliances, military encirclements, and diplomatic pressure on BRICS states makes it clear: The Pacific Rebalance and TPP were not the starting points of this geopolitical conflict but reactions to the BRICS challenge to U.S. hegemony. To believe otherwise is to ignore the deliberate, coordinated efforts to dismantle any serious alternative to Western financial and military supremacy.

Rumpelstiltskin’s Bargain: DOGE as Pretext for Corporate Capture

This collapse of regulatory frameworks has only accelerated under the successive administrations of Obama-Trump-Biden-Trump, culminating in the creation of the Department of Government Efficiency (DOGE) under Donald Trump, with Elon Musk as its figurehead—a move that epitomizes the transformation of public governance into a tool for private capital. Rather than improving government efficiency, this office serves as a modern Rumpelstiltskin, spinning public assets into private gold—draining the commons to enrich oligarchs under the guise of reform. Each iteration of this process further depletes state capacity, erodes public sovereignty, and reinforces the rise of what should be understood as an American Perestroika—a restructuring not for the people, but for the consolidation of wealth and power into fewer and fewer hands.

Under this American Perestroika, oligarchs have gained near-sovereign influence over the United States, leveraging debt crises and deregulation to consolidate power beyond the reach of traditional democratic institutions. While some may argue that the U.S. arrived at this moment through a centuries-long "Comedy of Errors," the reality is far more dire: this has been a "Tragedy of the Commons" on a national and global scale. The U.S. economic order has been built upon genocide, slavery, theft, fraud, and dispossession. The so-called "free market" was never free, but rather an elaborate mechanism for the systematic monopolization of wealth and power.

If the United States has been an experiment in industrial and corporate capitalism, a project of market supremacy, middle-class co-optation, creative ingenuity, and corporate espionage, then the final construct of American Perestroika is its inevitable outcome. What we are witnessing today is precisely what Lenin describes as the "interlocking" monopolistic capture of finance and industry, or more specifically, what Ernest Mandel later characterized as "Late Capitalism"—an era where the integration of financial speculation, technological monopolization, and the erosion of state sovereignty accelerate capitalism’s contradictions rather than resolve them.

This maturation is a cybernetic oligarchy, where capital, data, and military power have become nearly indistinguishable. The American Perestroika—unlike its Soviet namesake, which signaled collapse—has instead allowed for a consolidation of economic, political, and technological control into the hands of a few. What began as deregulation in the late 20th century has now metastasized like a cancer, into something far more entrenched: a corporate-sovereign order, where the line between private enterprise and state governance is essentially obsolete.

This was not an accident, nor merely the result of neoliberalism’s failed promises. It has been a methodical process, an imperial restructuring that has both dismantled and co-opted the very democratic and legal institutions that once constrained corporate power. The early 21st century saw financial crises and mass technological expansion coincide with military interventions and destabilizations, the rise of surveillance capitalism, and the normalization of corporate rule under the guise of innovation. The financial collapse of 2008 was a key inflection point—a moment that should have resulted in systemic reform but instead was leveraged to cement the power of hedge funds, financial cabals, and technological elites. What followed was not recovery, but a transformation of sovereignty itself.

The Network State: Sovereignty without Public Oversight

The Network State has been described as a techno-fascist nation-state concept driven by venture capitalists and tech billionaires, operating through a decentralized web while maintaining centralized control over governance, legal structures, and economic models. Fascism, however, relies on state nationalism, militarization, and mass ideological control, whereas the Network State does not centralize power through ideology but through financial and technological architecture that is more like a Financialized Data State.

The militarization of AI, the expansion of corporate-led governance (from California Forever to Próspera), and the deployment of capital as a force of conquest—all of these phenomena are interlocking. They mark the transition from an era of industrial-military supremacy to one of data-military supremacy, where the primary extractive resource is no longer just land, oil, or labor, but the very infrastructure of knowledge, behavior, and algorithmic governance itself.

The tragedy of this data cabal is that it presents itself as progress: the march of innovation, the expansion of choice, the triumph of a “frictionless” world. In reality, it is an insidious reordering of social relations, a final enclosure of the commons into a privatized digital-cybernetic feudalism, governed by entities that are neither democratic nor accountable. The dream of sovereignty—the foundational myth of the United States—has been privatized, leveraged by billionaires, who now seek to build their own nations within and beyond the existing state framework. There’s no need for a Constitutional Convention to reorganize state’s rights, these sovereign privatized spaces are already a reality.

We are not merely in a post-democratic age; the impact of Cambridge Analytica on the 2016 election has already ushered us into an era where democracy itself has become an outmoded technology, discarded in favor of programmable governance. Our job then, should be to recognize how these spaces interact with our lives, and to reengage with the world with a new filter for resisting data colonialism.

From Arbitration to Automation: The Rise of the Robot Contracts

Unlike traditional states, the network state’s legal framework is embedded within the digital trade and electronic commerce chapters of investment agreements such as the USMCA and CPTPP, as well as bilateral investment treaties (BITs). These mechanisms provide the jurisdictional loopholes that allow the Network State to function outside national legal frameworks while maintaining sovereign-like authority over its inhabitants.

Taking advantage of free trade agreements (FTAs), data-based governance presents itself as a neutral, even progressive alternative to traditional forms of economic extraction. Unlike the overt violence of resource mining, land grabs, and forced displacement, data-driven governance operates under the guise of efficiency, transparency, and technological advancement. It claims to optimize public services, streamline decision-making, and foster economic growth. However, this digital veneer masks a deeper continuity with historical forms of colonialism and exploitation. Instead of bulldozers and armed enforcers, the new enclosures are executed through algorithmic controls, smart contracts, and biometric surveillance. While it may lack the immediate visible destruction of strip mining or deforestation, data-based governance reinforces economic displacement, as communities lose control over their information, economic participation is conditioned by digital compliance, and sovereignty is gradually eroded under the weight of unregulated tech monopolies. Worse, its impacts on health and the environment may be just as devastating, as decisions driven by data abstraction frequently privilege efficiency over ecological sustainability and commodify human well-being under the logic of optimization. In many ways, data-based governance is not a substitute for traditional extraction, but rather its next evolutionary phase—one that operates more invisibly, but no less destructively, within the expanding architecture of digital capitalism.

The problem with these agreements lies in enforcement mechanisms. Investor-State Dispute Settlement (ISDS) remain a hegemonic threat imposing lawfare on governments and peoples, and since its inception has posed the greatest threat to people and planet by utilizing an enforceable private legal infrastructure that privileges the narrow terms of the investors over the broader unforeseen impacts of the investment. ISDS treaties originated in the 1960s during the Soviet-led, Decade of Decolonization. Former colonial powers wanted to protect their corporations' wealth in newly independent countries, and these treaties were a means to obstruct self-determination.

When the World Trade Organization (WTO) was established in 1995—shortly after the dissolution of the Soviet Union—Investor-State Dispute Settlement (ISDS) mechanisms became the norm, functioning as the de facto enforcement mechanism for corporate rights within the global neoliberal order. Through BITs and FTAs, ISDS granted corporations the ability to sue sovereign governments in international arbitration courts for any policy or regulation that threatened their expected profits—even if those policies were enacted in the public interest, such as environmental protection, labor laws, or public health measures. This system effectively subordinated national sovereignty to corporate rule, making governments financially liable for enacting regulations that interfered with corporate investment.

By institutionalizing investor rights over democratic governance, ISDS transformed economic policymaking into a risk-management exercise for transnational capital. Governments—especially those in the Global South—were pressured into a kind of self-censorship, avoiding regulations that could provoke lawsuits from multinational corporations. This ensured that corporate interests dictated economic policy, while public welfare took a backseat to market efficiency and investment security.

Now, however, as the digital economy and blockchain-based governance emerge as the next phase of global capitalism, ISDS is evolving beyond its traditional legal framework with Smart Contracts and tokenized governance. Within the Network State model, arbitration mechanisms may no longer require legal tribunals at all. Instead, contract enforcement is being automated, embedded in code, and executed without state oversight. In this new era, corporate control will not just be defended in international courts—it will be programmed into the infrastructure of governance itself. The question is no longer whether private capital overrides democracy, but how it will entrench its sovereignty in a world where legal recourse is becoming obsolete.

Further, while ISDS mechanisms share some similarities with smart contracts—particularly in how they allow corporations to override national laws and challenge government regulations—they are not the same. ISDS operates within the framework of international trade law, enabling corporations to sue governments for policies that threaten their expected profits. Smart contracts, on the other hand, function within privatized digital jurisdictions, enforcing agreements automatically and often beyond the reach of state governance.

The convergence, however, of ISDS and smart contracts should be the concern, especially as blockchain-based governance expands into Special Economic Zones (SEZs) and other Network State projects. The danger lies in how smart contracts can be used to encode corporate sovereignty, where financial and governance decisions are predetermined and automated in ways that prevent local communities, governments, or courts from intervening. This is likely to create a new enforcable form of automated ISDS, where legal recourse is impossible because the contract executes itself.

Unlike traditional contracts, which require legal adjudication, smart contracts eliminate the need for intermediaries like courts or regulatory bodies, instead relying on code to govern transactions and enforce compliance. They are a key tool in data-based governance, especially within the Network State model, where private actors seek to replace traditional government functions with automated, algorithmic, AI enforcement.

Enter the Dragon: How BRICS could counter the Network State model

This doom and gloom scenario is not inevitable though. Under BRICS multilateralism, formalized in 2014 with the Fortaleza Declaration (21), ISDS is being revised, away from the predatory arbitration system towards more traditional mediation and conciliation through new rules and procedural frameworks.

The BRICS economies promote a multipolar internationalism that, in key respects, aligns more closely with the 1946 UN Charter’s principles of sovereign equality and non-interference than the Western financial order shaped by the Marshall Plan. As mentioned earlier, the Marshall Plan established U.S.-led economic dominance, using UN institutions to advance Western financial hegemony, while the 1951 Mutual Security Act coordinated the blueprints for militarized global economic alignments, escalating the Cold War with the Military-Industiral Complex.

As BRICS strengthens its influence through alternative economic institutions—such as the Asia Infrastructure Investment Bank (AIIB), New Development Bank (NDB), alternative SWIFT systems (CIPS or BRICS-Pay), and regional trade blocs—it will likely develop countermeasures to resist Network State incursions and ensure that governance remains within sovereign control. One primary strategy will be tightening oversight over Special Economic Zones (SEZs), as these corporate enclaves have become key entry points for Network State operations. By reinforcing state jurisdiction over SEZ regulations, BRICS nations can limit the ability of corporate entities to operate outside national oversight.

Additionally, some BRICS members, such as China and Russia, already restrict private arbitration in critical sectors, and this approach may expand to outlaw non-state dispute resolution mechanisms, ensuring that disputes remain under national legal frameworks rather than privatized courts. Another critical move will be forcing crypto and smart contract compliance by requiring all financial transactions to flow through national banking regulations, preventing Network States from using tokenized economies to bypass sovereign control. BRICS may also develop its own digital sovereignty framework, launching state-backed blockchain and AI governance systems to counter private Network State models, ensuring that data, digital transactions, and governance tools remain under national control and oversight.

Furthermore, BRICS-led multipolar alliances—such as the Shanghai Cooperation Organization (SCO), the Eurasian Economic Union (EAEU), ASEAN, the African Union, Mercosur, Caricom, and other South-South cooperatives—could refuse to recognize Network State sovereignty, isolating these private jurisdictions from major trade networks. If BRICS succeeds in restoring sovereignty over investor-state disputes, the Network State model will struggle to gain a foothold in BRICS-aligned economies, forcing it to retreat to cooperative jurisdictions within the OECD, or attempt direct confrontations with state power from tethered states.

The Inevitable Showdown

The interaction between these two models will likely be tense, strategic, and fraught with contradictions.

Small economies and regional integrations like the Pacific Island Forum, Caricom, and the Bolivarian Alliance, or even the largest regional integrations like the AfCFTA, Mercosur, ASEAN, and the EAEU should be studying the future implications of what the Network State is and how Big Data accumulation will undermine state sovereignty and disrupt economic integrations.

It is in this context that regional integrations need to look at environmental data accumulation through carbon credit schemes, REDD+, Loss and Damage insurance schemes, Maritime Protection Areas, and other Big Conservation schemes as backdoor data schemes. As discussed in a previous post, while it is not a smoking gun, one should at least question why the World Bank values Natural Capital at $100 trillion, roughly the same as global debt, the lion’s share owed by the US and the OECD countries. If that doesn’t prove a point, then countries should take back ownership of their data and pursue data markets that benefit their needs and economies rather than enrich Western tech monopolies that are taking advantage of governments and communities that do not yet understand the value of their data.

While BRICS seeks to restore state control over investment disputes, build a multipolar financial system, and prevent Western-led financial coercion, the Network State aims to leverage the massive US/OECD debt to bypass state control entirely, replacing legal arbitration with algorithmic enforcement and transforming governance into a monetized, privatized service.

Arguably these two models are inherently incompatible, as BRICS works to reform ISDS in a way that empowers national sovereignty, while the Network State seeks to eliminate ISDS altogether, replacing it with automated corporate rule that exists outside the reach of state mediation. The coming decade will be a crucial battleground, determining whether BRICS-led multipolar governance can successfully regulate and contain the rise of data hegemony, or whether these digital enclaves will secure autonomous footholds beyond traditional state control, permanently altering the global economic order.

The neoliberal economy represented by the OECD and the BRICS bloc embody two fundamentally competing visions for the future of global governance—but this competition is not about who wins influence over the Global South; rather, it is about what kind of economy the Global South chooses to participate in. Will it remain tethered to a colonial economic order, where sovereignty is nominal while capital flows remain controlled by external rentier elites, or will it assert the right to self-determination, developing an economic framework that prioritizes access, infrastructure, and equitable trade relationships within a South-South cooperative model? The answer to this question will shape not only the economic future of the Global South but the very structure of the emerging multipolar world order.

And Finally,

Building localized and regional data exchanges, countries can trade, share, and monetize their data on their terms, fostering AI development, digital infrastructure, and analytics that prioritize local industries, public interest, and equitable profit distribution. This means implementing data governance policies rooted in Free, Prior, and Informed Consent (FPIC), decentralized digital registries, and cooperative platforms that prevent foreign capital from monopolizing digital ecosystems. A South-South data market would unlock new economic opportunities, from local audit and trade verification to regional data models tailored for Global South interactions, ensuring that data is recognized not as a commodity to be extracted, but as a shared resource that strengthens economic and ecological sovereignty, encouraging communities to engage in a kind of reciprocity where local and indigenous ecological stewardship is valued.

While options may seem limited for small countries and regions facing economic coercion, election interference, sanctions, and misinformation campaigns, they are not powerless. The last decade provides many case studies of how BRICS-aligned countries have defended themselves from asymmetrical warfare and built resilience against external manipulation, but that’s another conversation.